PPP Loan Forgiveness & Taxation

The SBA resumes receiving applications for the PPP loan today, following the second round of funding that was approved by Congress last week. At this point, it appears that about 30% of those of you who have applied for the PPP Loan have received funding. I’m hopeful that the other 70% will be approved and funded this week or next week at the latest.

There are two questions we are receiving from employers who have received PPP loan proceeds: (1) How much of this loan is forgivable? And (2) How much of this loan is taxable?

PPP Loan Taxation

The taxability question is easiest, so we’ll address that first. The PPP loan is either forgivable or must be repaid. The portion that is forgivable is not taxable, and the portion that must be repaid clearly isn’t taxable because it must be repaid. So no part of the PPP loan is taxable to recipients.

PPP Loan Forgiveness

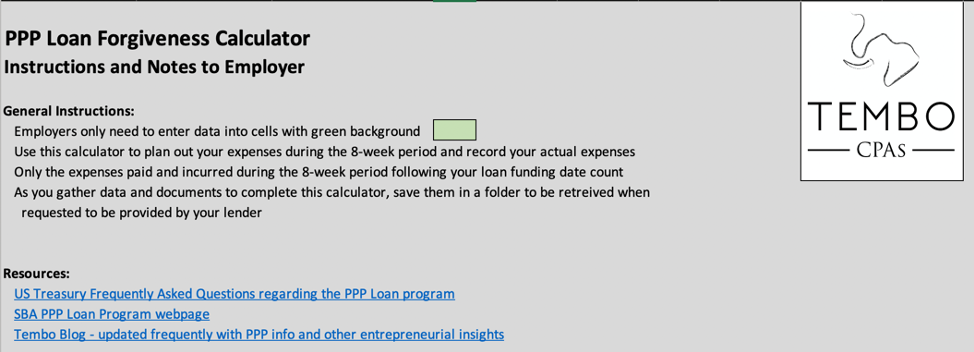

The goal, for the vast majority of recipients is to maximize the forgivable portion of the loan. Some see the loan as a cheap form of short-term financing and intend on repaying it, but the vast majority of employers that we speak to want to maximize forgiveness of the loan. We have spent the last week studying the CARES Act, the Interim Final Rules, the Treasury’s FAQs, and publications by industry leaders in order to provide you with a calculator you can use to help you track expenses that qualify for loan forgiveness and maximize forgiveness of the PPP loan.

Tembo PPP Loan Forgiveness Calculator

Based on everything we reviewed, we developed the Tembo PPP Loan Forgiveness Calculator and are making this available to you. You may want to save several different versions as you work with it. Here is the link:

Disclaimer: This email, blog post, and loan forgiveness calculator have been created based on the prevailing guidance available at the time published and based on our interpretation of that guidance. It is possible our interpretations are not correct, the guidance will change, additional guidance will be issued, or subsequent rules will be passed that substantially change the way the forgiveness calculation works. Such changes may materially impact the results of the forgiveness calculation.

What You Need to Know

Before you start using the file, here are some things you need to know about the calculator and PPP loan forgiveness:

- There are quite a few areas in which the SBA and Treasury need to issue guidance and clarification. When they do, it may change the way the calculator works. We will do our best to notify you about these changes.

- The only expenses considered in the forgiveness calculation are the expenses that are “paid and incurred” in the eight (8) weeks following the date you receive your loan disbursement. Throughout this email, post, and calculator, we refer to this as the 8-Week Period. The expenses you incurred prior to receiving the loan are not considered in the calculation of what may be forgiven.

- There is no guidance on what “paid and incurred” means yet. If your rent becomes due during the 8-Week Period and you pay it, that seems pretty clear that it would be a qualifying expense. What if the 8-Week Period ends June 15, your rent becomes due June 20 and you decide to pay it early on June 15? That is an expense that is paid but may not be determined to have been “incurred.” These are the kinds of interpretations we are going to need from the SBA and Treasury.

- You don’t get the choose the 8-Week Period of expenses for loan forgiveness. It is very clear that the 8-Week Period begins the day you receive the loan disbursement and ends 8 weeks (56 days) later.

- If you receive the Economic Injury Disaster Advance ($1000 per employee, up to $10,000) and you receive the PPP loan, the EID advance will convert to an unforgivable portion of the PPP loan and will need to be repaid.

- You are going to need to access your employment records from 2019 and Jan/Feb 2020 and be able to recreate your headcount during the February 15 through June 30, 2019 and the January – February 2020 time frames. See the calculator for requirements and know that this may be a time-consuming process if you don’t use a payroll company (like ADP or Paychex) or your payroll company doesn’t track headcount for you.

Headcount Reduction Rule

One of the most complicated sections of the PPP loan forgiveness rules is the application of the headcount reduction. Essentially, it works like this:

- If your Full Time Equivalent employee headcount (FTEs) during the 8-Week Period is equal to or greater that your FTE headcount during Feb-June 2019 or Jan-Feb 2020 (the “Prior Period Headcount”), then this reduction rule will not apply to you,

- If by June 30, you have restored your FTE headcount to the Prior Period Headcount, then this reduction rule will not apply to you,

- For all other employers, whose FTE headcount during the 8-Week Period is less than the FTE headcount during the Prior Period Headcount, then the forgivable portion of your PPP loan is reduced by your FTE headcount reduction percentage.

There are many variables in calculating the headcount reduction percentage, but here is a simple example to illustrate the headcount reduction percentage concept.

Example: Suppose you had 10 FTEs during the Feb-June 2019 period and you had 12 FTEs during the Jan-Feb 2020 period. Your Prior Period Headcount is the lesser of these two, or 10. Assume that during the 8-Week Period, you have 8 FTEs. Your headcount reduction is 2/10 or 20%, which is your headcount reduction percentage. Assume your PPP loan was $80,000 and you had $80,000 of qualifying expenses. Before considering the headcount reduction percentage, you may be entitled to a full $80,000 PPP loan forgiveness. The headcount reduction percentage must be applied to the amount of qualifying expenses, though, so 20% of $80,000 = $16,000. That means the maximum amount of loan forgivable is $64,000 and you will be obligated to repay $16,000 of the PPP loan.

Tips and ideas for maximizing forgiveness:

- The most important concept, from our perspective, is that during the 8-Week Period you either spend the money on qualifying expenses, or you will be obligated to pay it back. Either way, it is a cash outflow, so you might as well spend the funds on qualifying expenses. So, the key here is to make sure you capture all the qualifying expenses you possibly can.

- Since payments to contractors do not count, consider converting them to employees so that their payments do count as qualifying expenses.

- If you normally pay bonuses later in the year, consider paying (all or a portion) of the bonuses early and during the 8-week period.

- Please note that the maximum amount that can be paid to any one employee, including bonuses and commissions, is $15,384 during the 8-Week Period.

- Consider changing your payroll periods a little to capture one extra pay period within the 8-Week Period.

- Consider paying other family members. Help qualifying expenses, helps with headcount (counted as full-time)

- Funding current year/prior year retirement plan contributions

- Pre-pay rent or increase rent (subject further guidance)

- Save a “Planning” version of the calculator and enter projected expenses so you can see what your forgivability result may be based on your projected expenses.

- Document your expenses during the 8-Week Period. Your lender will require you to submit documentation of your expenses to support your certification statement that you’ve used the loan proceeds for forgivable purposes. It’ll be way easier to document and collect these expenses as you go than trying to find the documentation after the 8-Week Period.

How Tembo Will Help:

As always, we are here and committed to your success with the PPP loan program. We are available via email at [email protected], via phone at 866-558-3626, or via your preferred Tembo Team Member. Please note that all projects related to the PPP loan are considered “out of scope” under all client service agreements. We are being extremely liberal with the time we spend working with clients on PPP loan projects, but the in-depth support may require additional fees over and above our normal fee agreements. This may especially be true if you are an employer who is not using a payroll company like ADP, Paychex, Paycor, or similar.

Please contact us if you have any questions or need help with the calculator.