Good news!

Just in the last hour the House passed HR 748 – CARES Act and the President has signed it. The bill, as it pertains to small businesses, remained unchanged from.

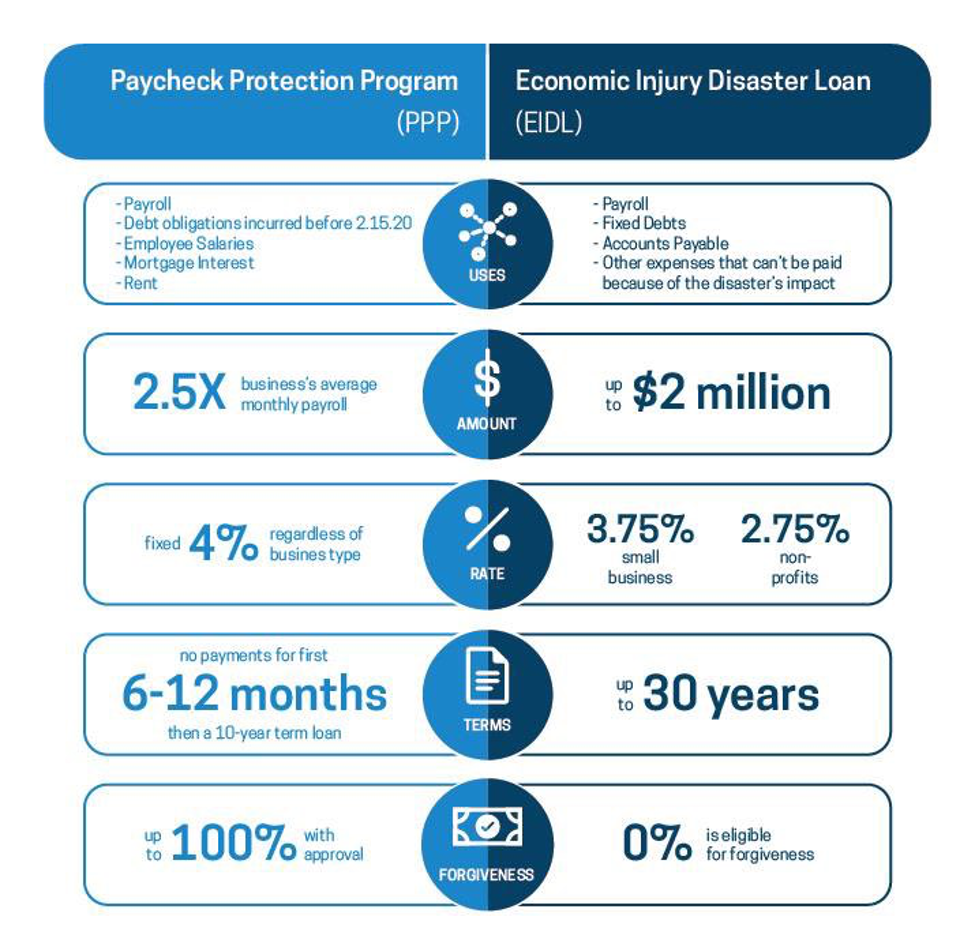

Here are the final terms:

- The maximum loan amount from a 4X factor to a 2.5X factor

- Rent and utility payments are included in the forgivable amount

- Maximum loan amount is driven by average monthly payroll. Debt obligations, rent, utilities have been eliminated from the calculation of the maximum loan amount.

- It is pretty simple to calculate now – average monthly payroll x 2.5 = maximum loan amount.

- The loans are non-recourse, unless proceeds are used for non-approved purposes (meaning, no personal guarantee)

- Not more than 10-year term for portion of loan not forgiven

- Interest rate not more than 4% (currently 3.75%

- Minimum 6-month deferment on any payments on the loan

- There is a provision allowing for self-employed (read “1099 contractors”) to apply for their own loan. So, if you’re a business owner who pays “employees” via 1099, those 1099 contractors will need to apply for their own loan. It’s unclear what the loan amount would be for them.

Please note that many people have been confused by the Economic Injury Disaster Loan (“EIDL”) that is available now on the SBA website. You have to download the forms and mail them in to apply. This is not the new loan that just became law!

This chart describes the Paycheck Protection Program (PPP) loan, which is what is outlined above and was included in the CARES Act. This chart compares the PPP to the EIDL program that already existed in the SBA. Note that the PPP is the loan that is forgivable! This is the one we recommend our clients apply for, and we recommend you wait for the SBA to update its website to allow for online applications for the PPP loan.

Be sure to subscribe to our blog to stay in the loop:

SubscribeAnd follow us on social media!

Cheers,

Ben & The Tembo Team