Value Drivers

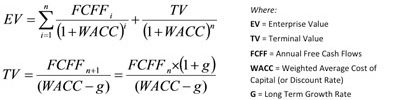

Let’s talk about the elephant in the room. Most, if not all, business owners want to grow the value of their business, but the vast majority of them do not fully understand what drives business value. Is it cash flow? Profitability? Revenue growth? Sure, it can be any or all of those things. The formula behind business value is pretty simple though:

Business Value = Present Value of (all future expected cash flows) / (expected risk rate)

It is all future expected cash flows, discounted back to present value, using a discount rate, or risk rate, that is appropriate for the business. When considering an “expected risk rate,” think about the difference between CD rates and stock market risk rates. CDs typically pay 1% or less, because there is very, very little expected risk. Stock market returns are in the 13% range, historically, because there is much greater expected risk.

So, there are many factors that con contribute to the value of your business. Assuming you want to grow the value of your business, then Tembo can help you identify the factors that are most significant in determining value for your business, and can then help you focus on improving those factors so that you create as much value as possible.